Paul Krugman got it right. But it should not have taken a Nobel Laureate to note that the emperor's nakedness with respect to the connection between the housing bubble and more restrictive land use regulation.

A just published piece by the Federal Reserve Bank of Boston, however, shows that much of the economics fraternity still does not "get it." In Reasonable People Did Disagree: Optimism and Pessimism About the U.S. Housing Market Before the Crash, Kristopher S. Gerardi, Christopher L. Foote and Paul S. Willen conclude that it was reasonable for economists to have missed the bubble.

Misconstruing Las Vegas and Phoenix: They fault Krugman for making the bubble/land regulation connection by noting that the "places in the United States where the housing market most resembled a bubble were Phoenix and Las Vegas," noting that both urban areas have "an abundance of surrounding land on which to accommodate new construction" (Note 1).

An abundance of land is of little use when it cannot be built upon. This is illustrated by Portland, Oregon, which is surrounded by such an "abundance of land." Yet over a decade planning authorities have been content to preside over a 60 percent increase in house prices relative to incomes, while severely limiting the land that could have been used to maintain housing affordability. The impact is clearly illustrated by the 90 percent drop in unimproved land value that occurs virtually across the street at Portland's urban growth boundary.

Building is largely impossible on the "abundance of land" surrounding Las Vegas and Phoenix. Las Vegas and Phoenix have virtual urban growth boundaries, formed by encircling federal and state lands. These are fairly tight boundaries, especially in view of the huge growth these areas have experienced. There are programs to auction off some of this land to developers and the price escalation during the bubble in the two metropolitan areas shows how a scarcity of land from government ownership produces the same higher prices as an urban growth boundary

Like Paul Krugman, banker Doug French got it right. In a late 2002 article for the Nevada Policy Research Institute, French noted the huge increases auction prices, characterized the federal government as hording its land and suggested that median house prices could reach $280,000 by the end of the decade. Actually, they reached $320,000 well before that (and then collapsed).

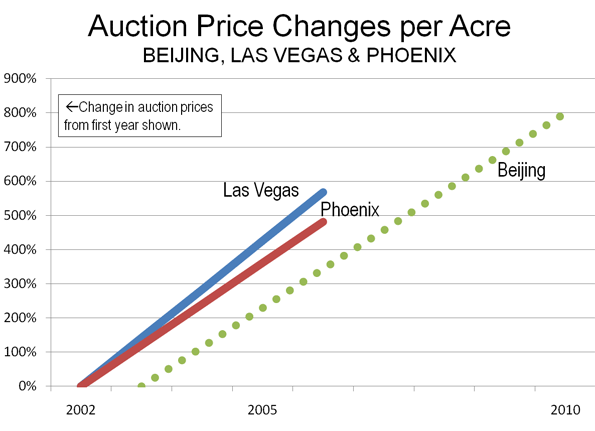

In Las Vegas, house prices escalated approximately 85% relative to incomes between 2002 and 2006. Coincidentally, over the same period, federal government land auctions prices for urban fringe land rose from a modest $50,000 per acre in 2001-2, to $229,000 in 2003-4 and $284,000 at the peak of the housing bubble (2005-6). Similarly, Phoenix house prices rose nearly as much as Las Vegas, while the rate of increase per acre in Phoenix land auctions rose nearly as much as in Las Vegas.

In both cases, prices per acre rose at approximately the same annual rate as in Beijing, which some consider to have the world's largest housing bubble. According to Joseph Gyourko of Wharton, along with Jing Wu and Yongheng Deng Beijing prices rose 800 percent from 2003 to 2008 (Figure). This is true even thought we are not experiencing the epochal shift to big urban areas now going on in China.

The Issue is Land Supply: The escalation of new house prices during the bubble occurred virtually all in non-construction costs such as the costs of land and any additional regulatory costs. It is not sufficient to look at a large supply of new housing (as the Boston Fed researchers do) and conclude that regulation has not taken its toll. The principal damage done by more restrictive land regulation comes from limiting the supply of land, which drives its price up and thereby the price of houses. In some places where there was substantial building, restrictive land use regulations also skewed the market strongly in favor of sellers. This dampening of supply in the face of demand drove land prices up hugely, even before the speculators descended to drive the prices even higher. Florida and interior California metropolitan areas (such as Sacramento and Riverside-San Bernardino) are examples of this.

Missing Obvious Signs: There are at least two reasons why much of the economics profession missed the bubble.

(1) Unlike Paul Krugman, many economists failed to look below the national data. As Krugman showed, there were huge variations in house price trends between the nation's metropolitan areas. National averages mean little unless there is little variation. Yet most of the economists couldn't be bothered to look below the national averages.

(2) Most economists failed to note the huge structural imbalances that had occurred in the distorted housing markets relative to historic norms. Since World War II, the Median Multiple, the median house price divided by the median household income, has been 3.0 or less in most US metropolitan markets. Between 1950 and 2000, the Median Multiple reached as high as 6.1 in a single metropolitan area among today's 50 largest, in a single year (San Jose in 1990, see Note 2). In 2001, however, two metropolitan areas reached that level, a figure that rose to 9 in 2006 and 2007. The Median Multiple reached unprecedented and stratospheric levels in of 10 or more in Los Angeles, San Francisco, San Diego and San Jose- all of which have very restrictive land use and have had relatively little building. This historical anomaly should have been a very large red flag.

In contrast, the Median Multiple remained at or below 3.0 in a number of high growth markets, such as Atlanta, Dallas-Fort Worth and Houston and other markets throughout the bubble.. Even with strong housing growth, prices remained affordable where there was less restrictive land use regulation.

Seeing the Signs: Krugman, for his part, takes a well deserved victory lap in a New York Times blog entitled "Wrong to be Right," deferring to Yves Smith at nakedcapitalism.com who had this to say about the Federal Reserve Bank of Boston research:

It is truly astonishing to watch how determined the economics orthodoxy is to defend its inexcusable, economy-wrecking performance in the run up to the financial crisis. Most people who preside over disasters, say from a boating accident or the failure of a venture, spend considerable amounts of time in review of what happened and self-recrimination. Yet policy-making economists have not only seemed constitutionally unable to recognize that their programs resulted in widespread damage, but to add insult to injury, they insist that they really didn’t do anything wrong.

Maybe we should have known better: beware economists bearing the moment’s conventional wisdom.

------

Note 1: The authors cite work by Albert Saiz of Wharton to suggest an association between geographical constraints and house price increases in metropolitan areas. The Saiz constraint, however, looks at a potential development area 50 kilometers from the metropolitan center (7,850 square kilometers). This seems to be a far too large area to have a material price impact in most metropolitan areas. For example, in Portland, the strongly enforced urban growth boundary (which would have a similar theoretical impact on prices) was associated with virtually no increase in house prices until the developable land inside the boundary fell to less than 100 square kilometers (early 1990s). A far more remote geographical barrier, such as the foothills of Mount Hood, can have no meaningful impact in this environment.

Note 2: William Fischel of Dartmouth has shown how the implementation of land use controls in California metropolitan areas coincided with the rise of house prices beyond historic national levels. As late as 1970, house prices in California were little different than in the rest of the nation.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life”

Photograph: $575,000 house in Los Angeles (2006), Photograph by author

The cause of the housing

The cause of the housing bubble was multi-tiered. In the US I'd say the largest enabler was the availability of creative financing. The entire financial industry was in bed with itself: Banks sold mortgages upriver where they were bought and packaged by investment banks who then paid ratings agencies to rate them at which point they were all rated with AAA ratings and later sold again to outside investors. This in turn fueled the machine that enabled ever-daring loan products for increasingly daring consumers who in turn encouraged home prices to rise. In short there was a total disconnect from financial reality because the system that created the bubble never relied on economic fundamentals to start with. The result is a housing market that even to this day suffers from being oversold and overpriced. We still have a ways to go before actual incomes match housing prices- especially in markets like New York and San Francisco.

I would also agree that some part of the US housing bubble was created by land restrictions. The bubble got its start in classic bubble markets, which again would be those like San Francisco and New York. These markets tend to have aggressive cycles of booms and busts yet these tend to stay within the region. The difference this time was that the bubble spread nation-wide.

Et Tu, TX1234?

You, too, TX1234, miss the point.

"......classic bubble markets, which again would be those like San Francisco and New York. These markets tend to have aggressive cycles of booms and busts yet these tend to stay within the region. The difference this time was that the bubble spread nation-wide....."

The bubble did NOT spread nation-wide. That is what Krugman noticed in the first place, Wendell Cox noticed it, Randall O'Toole noticed it, Alain Bertaud noticed it, Alan Moran noticed it, and a few others that make up a minority of yet-to-be-acknowledged honourable experts. Tell you who else noticed it - John Paulson, Steve Eisman, Kyle Bass - clever hedge fund operators who bought derivatives from stupid Wall Street firms, based ONLY on mortgages in California, Florida, and Arizona. These guys made a killing when the crash came.

Furthermore, TX1234, read the OECD Report "A Bird's Eye View of OECD Housing Markets". MOST OECD countries had a bubble at the same time as the USA's selective one. The only factor that explains ALL these bubbles, is the mania for restricting urban sprawl that has swept the planning community worldwide. "Innovative financing", low central bank interest rates, Fannie Mae and Freddie Mac, tax breaks, etc etc - NONE of these other scapegoat factors explain the worldwide epidemic of house price bubbles.

Because you Americans think the world revolves around Wall Street, you are acting as "fall guys" for other nations problems that actually are THEIR OWN FAULT. And their politicians are very, very grateful to have been handed this opportunity to "blame America again" and divert attention from their OWN ruination of their own economies. I am literally sickened by the ongoing regular occurrence of this phenomenon.

The retreat of the Urban Economists

When Don Brash, as Governor of the Reserve Bank of New Zealand at the time, in 1995, asked me to explain why house prices were rising while his policies had brought inflation under control in all other sectors, he exlained that he turned to me, an Architect/City planner, because his economic advisers could offer no explanation. However, he had noticed I had written a couple of columns in magazines complaining about compliance costs. Also, the thesis I had written in Aaron Wildavsky's Oakland Project did have "Urban development economics" as its subject matter.

I had already noticed that economists had moved towards a heavy emphasis on computer modelling and forecasting – traditional economics had morphed into econometrics.

Two or three authors had openly declared that "urban economies are so heavily regulated, and the decision making so politicised that our modelling techniques simply cannot be applied with any utility" – or words to that effect.

And for some reason, when they did enter these muddy waters they focused on demand and assumed supply was fixed - or lagged heavily behind.

It did not take me long to establish that behavioral analysis explained these rises in land prices (the costs of construction had actually fallen because of the deregulation of the import markets) by a massive increase in regulation of the land supply and an equal increase in direct compliance costs, couple with the increase in holding costs caused by more protracted decision making.

The report was not well received. Indeed I am still waiting for my Nobel Prize.

Probably because it did not contain a single equation anywhere.

You can read the report at my web page here (without some of the tables – this was prior to the digital age and I have had to re-type everything):

http://www.rmastudies.org.nz/documents/ResBankF.pdf

The Executive summary is a too long to post but the summary of general pinciples is manageable.

These words were written in 1996 and I would not change a word today. I even drew the connection between high land prices and employment.

General Principles

• General economic theory, and international experience, strongly indicate that the regulation of the supply of land should be light-handed, for reasons of both equity and efficiency.

• Policy makers must recognize, and must explain to their constituencies, that heavy-handed regulation of the supply of residential land carries a burden of significant economic and social costs. Such over-regulation affects prices, construction output and finally employment.

• In New Zealand those same price rises make a significant contribution to the CPI, which, in turn, forces a response from the Reserve Bank, which means that these distortions impact on the competitive performance of New Zealand's trading sector.

• Many of these costs fall most heavily on those least able to deal with them. Those already comfortably settled, benefit from the increased capital value of their properties. Those struggling to become established, find themselves paying higher prices for housing, or are priced out of the market altogether. A large percentage of the population who have a mortgage on their home or who have borrowed to finance their business or other activities are paying higher interest rates that necessary.

• Some increased costs associated with protection or enhancement of the environment are to be expected. As populations become wealthier, they demand higher environmental standards.

So, what's new?

Owen McShane, Kaiwaka, New Zealand.

Director, Centre for Resource Management Studies.

http://www.rmastudies.org.nz/