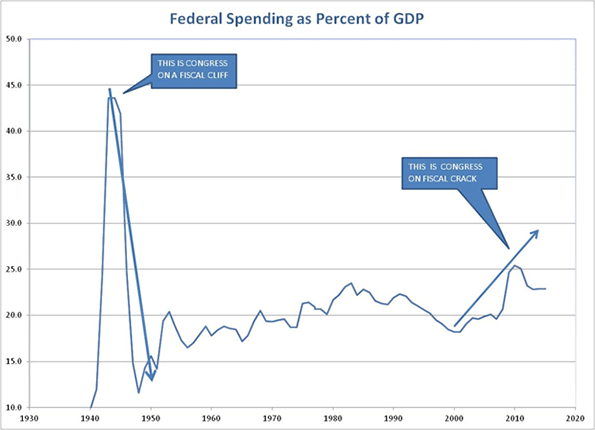

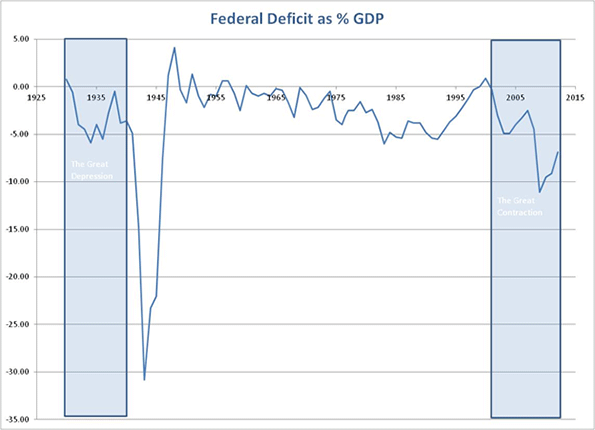

Forget about a fiscal cliff or the threat of sequestrations. Bernanke’s use of the term “cliff” in 2012 is based on the erroneous analogy that fiscal policy had been moving along some level road for a period of time and was just now approaching an “end” or “falling-off” point. The reality is that federal spending has been rising rapidly since the federal government 1) absorbed the cost of repairing the damage done by the terrorist attacks of 2001, 2) decided to support wars on multiple fronts in the Middle East, 3) bailed out the Wall Street Banks, and 4) failed to pass a budget but 5) decided to continue spending as if nothing had happened. So called “sequestration” – which in this case basically means reducing spending and increasing revenue – would simply be a return to reality, coming down to earth, getting our feet back under us. Unfortunately, we the people appear co-dependents in this addiction.

This year started with Congress succeeding at its favorite athletic event: kicking the can down the road. The January inauguration of the President and installation of their new members provided the excuse. The fact remains that Congress has not passed a real federal budget since 1997 (“the first balanced budget in a generation”.) An “omnibus spending bill” was passed in April of 2009 but that is not technically a budget.

Congressional inaction has left the federal government running on extensions (“Continuing Resolutions”) of a budget that was passed when Bill Gates was still CEO of Microsoft, NASA landed the first spacecraft on Mars, and Google was working out of a garage. The last federal budget is from the time before iPods and iPads, before SPAM e-mail exceeded legitimate email, before Facebook, YouTube and Twitter – and before the global financial crisis that sent the world into recession and US federal spending into the stratosphere.

In lieu of doing anything meaningful, three senators – Kelly Ayotte (R-NH), Ron Johnson (R-WI) and Marco Rubio (R-FL), all in office since 2011 – took the time to write and introduce an amendment to the 1974 Budget Act that would require a macroeconomic analysis of the impact of new legislation. This monumental act of denial was such a complete waste of time that GovTrack.us gave it only a 9% chance of getting out of committee and a 1% chance of being enacted. In fact, from 2011 to 2013, while we were paying these three senators and hundreds more people in Congress, only 12% of the bills introduced in the Senate made it out of committee (11% in the House) and only 14% of those were enacted (24% in the House)! Having passed just a few more than 200 bills, the 112th Congress will go down in history as even less productive than President Harry Truman’s "Do-Nothing Congress" (the 80th, 1947-1948) which nevertheless managed to get 906 bills enacted.

In the 2012 election, openings were available for 1 new president, 33 new senators and 435 new representatives. Instead, Americans re-elected the same President, 19 of the same senators (58%) and 351 of the same representatives (81%). As a result, the 113th congress looks a lot like the 112th.

Recently, President Obama signed an executive order to lift the 2009 freeze on federal employee salaries – including the salaries for all members of Congress. When Congress voted to rescind the executive order – they have to vote to prevent an automatic annual pay increase – they did it not just for themselves but for all federal employees. Then they kicked the can (of the “sequestration” spending cuts) down the road two more months.

Their final act in January was suspending the debt limit “at least until May 19”. H.R. 325 may turn out to be the bright spot in this whole mess despite the fact that it gives Geithner’s, now Lew’s, Treasury carte blanche for financing profligate spending. The “No Budget, No Pay Act” was written on Thursday January 3, 2013; introduced in the House on January 21st by Rep. Dave Camp (R-MI since 1991) and cosponsor Rep. Candice S. Miller (R-MI since 2003); passed in the House on January 23rd by a vote of 285-144; passed in the Senate on January 31st by a vote of 64 to 34.

According to the bill, if Congress does not pass a real budget by April 15, the salaries of the members of the chamber unable to agree to the budget will be held in escrow until either they pass a budget or the last day of the 113th Congress. All the new Democrat senators voted “aye”; all the new Republican senators voted “nay”. The new House members were mixed. The bill goes to President Obama this week for signature.

Assuming he signs it, H.R. 325 allows the federal government to borrow money beyond the record $16.4 trillion debt we already owe. That debt is 104.5% of 2012’s $15.7 trillion GDP. The budget deficit – which has to be covered by borrowing – is running over $1 trillion each year or about 7% of GDP. The deficit alone is 44% of federal receipts. In other words, the government is spending over 40% more than it earns! That’s your government on crack.

It is like living with a drug addict:

“Waiting for the problem to resolve itself will get you nowhere. What you are seeing now, if it isn’t already completely out of control, will get completely out of control.”

The difference is that we, the taxpayers and our children and our children’s children, have to shoulder the burden – something the families of addicts are advised not to do. In a democracy, the majority rules and the majority decided to continue to live with these fiscal crack addicts. For the rest of us, our choice has to be to try to remain optimistic – take the good news where you can find it. There are no “fiscal therapists” or “family support groups” for disgruntled voters. We must seek out the venues where we can talk about the problem openly, don’t be fooled when the fourth estate hides the crack vials to gain favor with the Washington and Wall Street elites and take care of ourselves.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Dr. Trimbath’s credits include appearances on national television and radio programs and the Emmy® Award nominated Bloomberg report Phantom Shares. She appears in four documentaries on the financial crisis, including Stock Shock: the Rise of Sirius XM and Collapse of Wall Street Ethics and the newly released Wall Street Conspiracy. Dr. Trimbath was formerly Senior Research Economist at the Milken Institute. She served as Senior Advisor on United States Agency for International Development capital markets projects in Russia, Romania and Ukraine. Dr. Trimbath teaches graduate and undergraduate finance and economics.

Lead photo: Marion Barry smoking crack, screenshot from FBI surveillance video footage in 1990 via Wikipedia Commons.

PayGo - Good point

It's questionable in my mind whether raising tax rates in fact raises revenue. Looking at a historical analysis of tax rates and the amount of revenue actually brought in relative to economic growth, it looks like the tax rates only matter a little. However, I like the idea that I think you introduce here of there being a *political* consequence to increased spending, that if spending increases, so do tax rates, ostensibly to pay for the increase in spending. Maybe it will. Maybe it won't, but at least the voters will feel a consequence for what they want in their own pockets, as opposed to getting the idea that it's a free lunch.

What about the GOP "bribe" to geezers before the 2004 election?

You did not mention the George W. Bush/Tom DeLay plan to reward elderly voters with a "free" (as in unfunded) prescription drug plan (Medicare Part D), which was rammed through Congress in 2003.

RE: Legislating bribes to voters

The Executive Editor sets the word count -- enough to make my point but not so much that I could list every harebrained piece of legislation passed in the last 15 years instead of a real budget.

Now that you bring it up, would a word like "unfunded" show up if the word "budget" were understood?

Thanks for reading and commenting,

Susanne

Follow me on Twitter: SusanneTrimbath

Understood

In my opinion, the Medicare Part D (the prescription plan) was a very good symbol of what has been very wrong with the United States. Millions of uninsured, medical expenses eating up an increasing a percentage of GDP, while those fortunate enough to be 65 years or older were granted an expansion of their benefits - benefits that they did not pay for.

RE: measuring congressional productivity

Yes, I understand your point about the quantity versus the quality of legislation: If any of the bills passed by the 112th Congress had been a real federal budget, we probably wouldn't be having this discussion, right?

Thanks for reading,

Susanne

Follow me on Twitter: SusanneTrimbath

Great post but one minor point

Passing fewer bills doesn't necessarily make them less productive. Their productivity ought to be measured by what the bills they pass do, rather than the sheer number.