"By 1970, the governments of the wealthy countries began to take it for granted that they had truly discovered the secret of cornucopia. Politicians of left and right alike believed that modern economic policy was able to keep economies expanding very fast -- and endlessly. That left only the congenial question of dividing up the new wealth that was being steadily generated."

Those words, from a Washington Post editorial more than twenty-five years ago, echoed the beliefs not only of politicians and the press, but of mainstream economics professionals resistant to the idea that growth in a market economy would ever stagnate over a protracted period.

And some of the data did fit nicely. Through several recessions and recoveries, inflation-adjusted GDP rose almost in tandem with a line of predicted growth expectations. But in November 2007, something changed. Real GDP dropped down from what was expected by more than 11 percent, and, as this summer's data has shown, it hasn't returned to its pre-recession trend.

The unusual slump has provoked a stream of commentary that attempts to define the problem, but it hardly matters whether the downturn is identified as the second dip of a 'double-dip' recession, a continuation of the 'Great Recession', a fast-moving slowdown, a slow nosedive, a long-term stall-out, or a confirmation that the economy has entered a Japanese-style 'lost decade'. Growth during the 21st century is following a different trend line than it did in the 20th, and employment is also responding in new, different ways from earlier post-World War II recessions.

A range of additional data also indicates that what we're hearing is not the regular breathing of an economy as it contracts and expands. Annual growth rates and quarterly moving averages — when examined starting in the mid 1970s, as Greg Hannsgen and I did at the Levy Economics Institute — show a steady decline beginning in 2000.

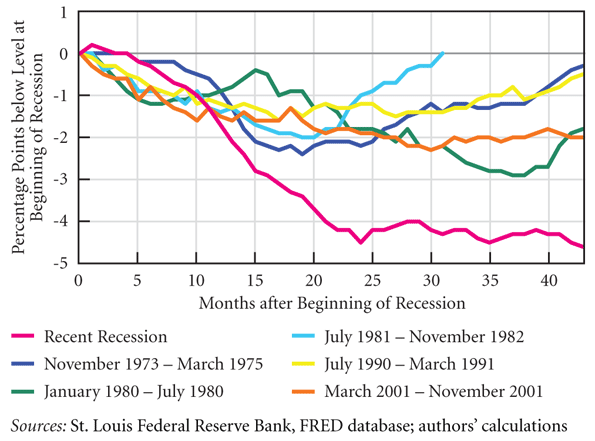

And the employment numbers make the case yet again. Look at the graph below, with separate lines for the past six recessions. It traces employment-to-population ratios, beginning with the first month of each recession. These ratios are used to measure, among other things, how well a nation utilizes its workforce— a kind of labor drop-out rate.

You can see at a glance that the pink line indicating the current recession — yes, that one down near the bottom of the chart — is an outlier in the group. It shows that by the 43rd month of the downturn, the ratio stood at just over 58 percent, meaning that 58 percent of the population was employed. That figure is 4.6 percent less than at the recession's start, when more than 62 percent were working. And it means that this employment decline is steeper, deeper, and longer than in any of the previous five recessions by a long shot.

Even in the two worst recoveries during the past forty years, this ratio never before declined by more than three percent. By the time the five recessions were this far along, employment had returned either to pre-recession levels, or to a distance from the recession's start that was, at worst, two percent, compared to the current more than four percent.

Together, this data makes the case that we're in a prolonged slump that's highly unusual, and requires action that's far more aggressive than the usual responses. Job creation should be the government's urgent, first priority. The nation needs to recognize just how perilous the employment disaster is — and what a marked departure this recession is from any we've seen in the modern era.

Dimitri B. Papadimitriou is president of the Levy Economics Institute of Bard College, and executive vice president and Jerome Levy Professor of Economics at Bard.

Photo by mangpages: Recession 1

Local Packers and Movers

Changing to another scenario is often a massive issue. Should you be furthermore going to create the shift to your dangerous position having a lot of factors throughout upcoming you’ll want for you to prepare definitely regarding it to create the product effectively successfully effectively properly secured and very quickly controllable.

Please visit for More information about -

Packers and Movers in Pune

Packers and Movers in Hyderabad

Packers and Movers in Mumbai

packers and movers kukatpally

Really great info i like your post very much ,i come back most days to find new posts like this! Good effort, it made me more knowledgeable I learnt it. Thanks. packers and movers kukatpally

Thank you for the sharing.

Thank you for the sharing. http://getrealigfollowers.com/buy-real-active-instagram-likes/

This is a great post. I like

This is a great post. I like this topic.This site has lots of advantage.I found many interesting things from this site. It helps me in many ways.Thanks for posting this again. - springbed murah

I really impressed after

I really impressed after read this because of some quality work and informative thoughts . I just wanna say thanks for the writer and wish you all the best for coming!.

Driving School UK

"By 1970, the governments of

"By 1970, the governments of the wealthy countries began to take it for granted that they had truly discovered watch Aikatsu! anime the secret of cornucopia. Politicians of left and right alike believed that modern economic policy was able to keep economies expanding very fast -- and endlessly. That left only the congenial question of dividing Denpa Kyoushi manga read up the new wealth that was being steadily generated."

Those words, from a Washington Post editorial more than twenty-five years ago, echoed the beliefs not only of politicia

what-is-a-reverse-mortgage

Fundamentally, a reverse mortgage is a loan based upon the equity a homeowner has available in their home. It allows you to receive government-insured money immediately, and repayment is not due until you are deceased or permanently leave your home. If you are 62 or older, own and live in your home with a mortgage of less than 50% of the appraised value of the house, or if you own your home free and clear, a reverse mortgage may benefit you. A reverse mortgage allows you to borrow against the equity you have accumulated in your home without repaying the loan for as long as you live there.

http://www.reversemortgagelendersdirect.com/what-is-a-reverse-mortgage/

hi

I thought it was going to be some boring old post, but it really compensated for my time. I will post a link to this page on my blog. I am sure my visitors will locate that extremely useful Please visit for more information -

nyc wedding

My spouse and i constantly

My spouse and i constantly come across a new challenge & diverse in this article. Victory gardens were planted in backyards and on apartment-building rooftops, with the occasional vacant lot "commandeered for the war effort!" and put to use as a cornfield or a squash patch. - Daftar rental mobil semarang

Not So Fast

One thing that is ignored in the economic history of the US since WWII is exactly how we got where we were and why we are no longer there.

We have always had the American exceptionalism advantage in that Americans have always been primarily interested in trade and making good. "Yankee Traders" were known around the world for making deals and supplying needs.

But, after WWII, the U.S was the only industrial power left standing. The ability of the rest of the world to produce both manufactured and agricultural products did not exist for all practical purposes.

So we got the America of the 1950's and 1960's with the Big Three making all the cars and the rest of the world depending on American products made or grown in America. The Communists, Russians and Chinese, were isolated and had no significant affect on world trade. India was off in a corner somewhere trying a quasi-socialist economy.

That was the 'good old days' that liberals like to reference when they talk about renewing the American economy.

Around 1970, Europe, Japan and Taiwan, to name the foremost, had not only recovered their industrial capabilities, but had matured them to the point where they could compete, marginally, with the established American companies.

American business started facing increasingly serious competition from them.

Then the Arabs came. The oil producing countries realized that they had a commodity that everyone else wanted and that it was a sellers, rather than a buyers market. That kicked over the oil barrel.

American's grumbled but adapted after President Reagan and his team dosed the economy with a modicum of realism. So we continued.

In 1989 The Berlin wall and Russian Communism crumbled. Around the same period, China decided that they should forgo isolationism and ventured into that area where the Chinese have always excelled, commerce.

In the past 20 years since then, the Russians have become big players in energy (Gazprom)and OPEC. They Chinese have moved into manufacturing in a big way.

This leaves us where we are today. It is not the 1950s or 60s anymore. Our exclusive franchise has been revoked and we are facing competition on a global scale in every area.

There still is the American exception though. We need to get back to being the "Yankee Traders" that got rich by exploiting opportunities. We cannot go back to being the exclusive top dog of the 'good old days'.

What we have right now is Obama and the Democrats trying to steer us into a highly regulated economy, a practice that has had limited success (and a lot of outright failures)elsewhere and is totally incompatible with American attitudes.

We need to be adaptable, flexible and quick to excel in the world economy. To steal a motto from the military "Semper Gumby" (Always Flexible)