NewGeography.com blogs

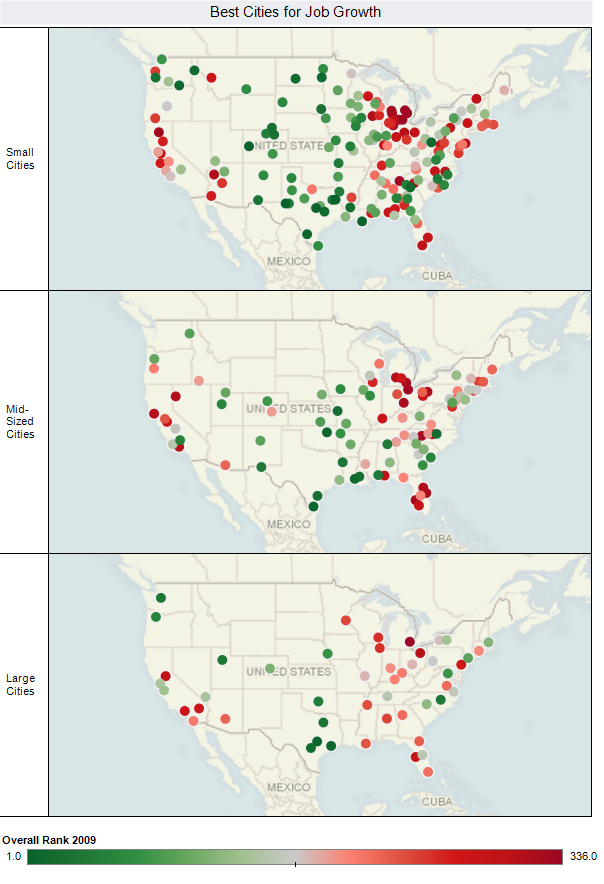

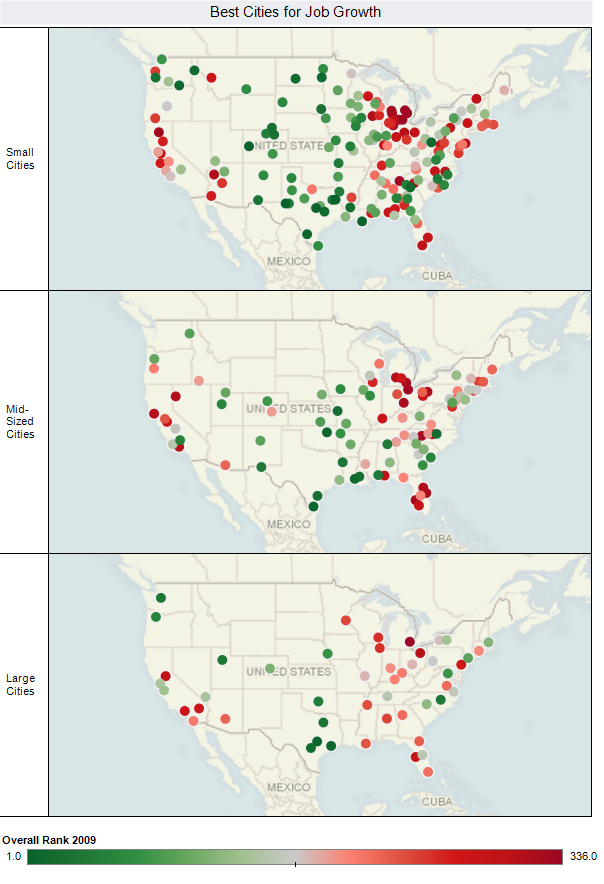

Here's some great maps of our annual Best Cities Rankings created by Robert Morton at Tableau Software. Robert used their software tool to plot a color coded point for each city in the rankings by size group, and immediate geographic patterns emerge:

Check out Robert's post for a map of the biggest gainers and losers from last year, and a rank change by size scatter plot of each place.

Austin fared very well on this year's Best Cities Rankings, and here's another interesting indicator of the difference in migration between Austin and San Francisco:

"When comparing California with Texas, U-Haul says it all. To rent a 26-foot truck oneway from San Francisco to Austin, the charge is $3,236, and yet the one-way charge for that same truck from Austin to San Francisco is just $399. Clearly what is happening is that far more people want to move from San Francisco to Austin than vice versa, so U-Haul has to pay its own employees to drive the empty trucks back from Texas."

This anecdote comes from a report comparing business environments in Texas to California.

Here's a table of the latest domestic migration numbers from US Census for all metropolitan areas of more than 1.5 million total population (rate numbers are per 1,000 population):

|

NAME

|

Population, 2008

|

Net Domesitc Migration Rate, 2008

|

Ave. Net Domesic Mig Rate, 2001-2008

|

| New York-Northern New Jersey-Long Island, NY-NJ-PA |

19,006,798 |

-7.6 |

-12.0 |

| Los Angeles-Long Beach-Santa Ana, CA |

12,872,808 |

-9.0 |

-12.2 |

| Chicago-Naperville-Joliet, IL-IN-WI |

9,569,624 |

-4.4 |

-6.8 |

| Dallas-Fort Worth-Arlington, TX |

6,300,006 |

7.0 |

5.7 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

5,838,471 |

-3.8 |

-2.3 |

| Houston-Sugar Land-Baytown, TX |

5,728,143 |

6.6 |

4.5 |

| Miami-Fort Lauderdale-Pompano Beach, FL |

5,414,772 |

-8.7 |

-5.1 |

| Atlanta-Sandy Springs-Marietta, GA |

5,376,285 |

8.2 |

10.2 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV |

5,358,130 |

-3.4 |

-2.9 |

| Boston-Cambridge-Quincy, MA-NH |

4,522,858 |

-1.8 |

-7.1 |

| Detroit-Warren-Livonia, MI |

4,425,110 |

-13.9 |

-9.1 |

| Phoenix-Mesa-Scottsdale, AZ |

4,281,899 |

12.3 |

17.9 |

| San Francisco-Oakland-Fremont, CA |

4,274,531 |

1.3 |

-10.5 |

| Riverside-San Bernardino-Ontario, CA |

4,115,871 |

-1.9 |

16.1 |

| Seattle-Tacoma-Bellevue, WA |

3,344,813 |

3.6 |

0.9 |

| Minneapolis-St. Paul-Bloomington, MN-WI |

3,229,878 |

-1.1 |

-1.0 |

| San Diego-Carlsbad-San Marcos, CA |

3,001,072 |

0.1 |

-4.8 |

| St. Louis, MO-IL |

2,816,710 |

-2.0 |

-1.8 |

| Tampa-St. Petersburg-Clearwater, FL |

2,733,761 |

2.4 |

12.9 |

| Baltimore-Towson, MD |

2,667,117 |

-4.6 |

-1.6 |

| Denver-Aurora, CO /1 |

2,506,626 |

7.3 |

1.8 |

| Pittsburgh, PA |

2,351,192 |

-1.0 |

-2.9 |

| Portland-Vancouver-Beaverton, OR-WA |

2,207,462 |

8.3 |

6.2 |

| Cincinnati-Middletown, OH-KY-IN |

2,155,137 |

-1.7 |

-1.2 |

| Sacramento--Arden-Arcade--Roseville, CA |

2,109,832 |

2.2 |

8.7 |

| Cleveland-Elyria-Mentor, OH |

2,088,291 |

-7.1 |

-7.5 |

| Orlando-Kissimmee, FL |

2,054,574 |

1.6 |

15.9 |

| San Antonio, TX |

2,031,445 |

11.5 |

10.4 |

| Kansas City, MO-KS |

2,002,047 |

0.7 |

1.5 |

| Las Vegas-Paradise, NV |

1,865,746 |

7.9 |

23.7 |

| San Jose-Sunnyvale-Santa Clara, CA |

1,819,198 |

-1.5 |

-16.4 |

| Columbus, OH |

1,773,120 |

1.4 |

1.8 |

| Indianapolis-Carmel, IN |

1,715,459 |

4.0 |

4.8 |

| Charlotte-Gastonia-Concord, NC-SC |

1,701,799 |

20.9 |

18.2 |

| Virginia Beach-Norfolk-Newport News, VA-NC |

1,658,292 |

-9.4 |

-0.6 |

| Austin-Round Rock, TX |

1,652,602 |

22.0 |

17.2 |

| Providence-New Bedford-Fall River, RI-MA |

1,596,611 |

-6.6 |

-3.7 |

| Nashville-Davidson--Murfreesboro--Franklin, TN |

1,550,733 |

10.9 |

9.6 |

| Milwaukee-Waukesha-West Allis, WI |

1,549,308 |

-4.2 |

-5.9 |

In the weeks leading up to the tepid re-election of Los Angeles Mayor Antonio Villaraigosa last month, Bill Bratton, the statistics-driven chief of the Los Angeles Police Department, appeared on TV in a political advertisement paid for by the Villaraigosa campaign. He cited a seemingly amazing figure about this city’s livability.

“Crime is down to levels of the 1950s,” said a confident-looking Bratton, who wore a black jacket and dark tie as he sat in an office conference room with downtown views.

Flashing across the screen as he delivered the line with his heavy Boston accent was a Los Angeles Daily News headline from early 2008 borrowed by the Villaraigosa campaign to further emphasize the chief’s claim. It read in bold, black letters: “Safest streets since ’56.”

On March 2, 24 hours before Election Day, Villaraigosa and Bratton teamed up again. This time, they appeared together at a morning press conference at the Police Academy in Elysian Park, where a statement from the Mayor’s Office made the rounds and trumpeted a “citywide crime-rate drop to the lowest level since 1956, the total number of homicides fall[ing] to a 38-year low. Gang homicides were down more than 24 percent in 2008.”

The 1956 number was simply incredible — Los Angeles had time-warped back more than 50 years to the era of the Beat Generation, Elvis Presley and Howdy Doody, when serious crime was still so titillating that murder trials featuring unknown faces were followed like big celebrity events. It wasn’t the first time Bratton made the claim — the chief had also made the bold comparison in 2006 and again in 2008, lugging it out to warn voters that the low crime rate could be jeopardized if they didn’t pass the City Council’s telephone-utility-tax referendum, a phone tax that Villaraigosa and Bratton said was needed for the hiring of more cops.

The press barely challenged the notion that Los Angeles has somehow been transported back five decades, and some instead focused on Bratton’s widely criticized political endorsement of the mayor — an unsettling and, many people believe, unethical move for a hired hand like a chief of police to engage in. One of the first to criticize Bratton’s claim was long-shot mayoral candidate Walter Moore. Moore couldn’t wrap his mind around the idea that Los Angeles is now as safe as the year that the L.A. Angels played baseball at a now-destroyed civic landmark — the beautiful old Wrigley Field in then-quiet, then-tidy South-Central Los Angeles.

“I’ve talked to people who grew up here in the 1950s,” Moore argued to nodding heads during a February debate between several mayoral candidates, held in the hilly, suburbanlike community of Sunland-Tujunga (sans Villaraigosa). “And believe me, nobody in L.A. remembers crime in the 1950s being like it is today.”

Moore isn’t the only one who finds it fishy, and just plain strange, to attempt to paint the city as similar to a time when 2.3 million residents lived in a far more suburban and far less dense metropolis, one in which residents often did not bother to lock their doors.

“It’s a silly comparison,” Malcolm Klein, professor emeritus of sociology at USC and a gang-crime expert, says bluntly. An author of numerous books on gang crime, Klein says that when Bratton starts publicly comparing crime levels of the 1950s to today, “You’re not listening to a chief of police, you’re listening to a politician.”

Read the extended version of this piece at LAWeekly.com

If you are going to San Francisco, be sure to say hello to mom, dad, and maybe your best friend from third grade.

California has traditionally been a land of migrants from around the country and around the world, but for the first time in the state’s history, the majority of California residents are native-born.

A study done by researchers at the University of Southern California has determined that more than 70% of those between the ages of 15 and 24 were born in the Golden State. Native-born Californians were also found to be less likely to move out of the state.

This increase in locally born residents comes with profound implications about the state’s future. For example, more workers will be educated in California, “putting a greater burden on the state’s taxpayers to pay for quality schools.” At the same time, with a greater number of residents staying in-state, a wealth of workers, taxpayers, and home buyers could keep more business from moving.

Additionally, as more people continue to put down roots, the potential support for investments in such public goods such as transportation networks and public universities could grow as more residents become committed to investing in California’s future.

Billionaire investor, Warren Buffett, is hosting the Berkshire Hathaway shareholder meeting “Capitalist Woodstock” in Omaha this weekend. Every news truck this side of Kansas City has been moved into town to cover the event.

While using words like “evil”, “folly” and “demented” to describe the activities that generated the global financial meltdown, Buffett’s partner, Charlie Munger, told CNBC in an interview that credit default swaps (CDS) should be outlawed completely. I have said clearly that Buffett’s strategy on CDS has gotten him in too deep. His strategy requires “new money” coming into the system regularly at a time when investors are pulling back.

Munger also says that “the people who make a lot of money out of the system as it is have a lot of political power and they don't want it changed." We think he must be speaking about Buffett here, too. Berkshire Hathaway is a financial company that benefits from the bailout of financial companies. Buffett must also be aware that the government will continue to make bailout payments, that will be passed along to CDS holders, just like the approximately $50 billion Uncle Sam passed out through AIG during the fall of 2008.

According to a report from Reuters, Berkshire Hathaway will not report their 1st quarter financial results on Friday and no new date or reason for the delay has been given. According to Bloomberg, the results will be delayed until six days after the meeting. There is some speculation at CNBC that Buffett may want to avoid some “terrifically worried” investors at the meetings this weekend. The stock price closed down $1,995 per share on Friday, May 1.

Jo Becker and Gretchen Morgenson (she reported on the lack of mortgages behind mortgage-backed securities) did a long piece on Treasury Secretary Timothy F. Geithner in the New York Times. They paint a stark picture of Secretary Geithner’s brand of “Collusive Capitalism”: lunch at the Four Seasons restaurant with execs from Citigroup, Goldman Sachs and Morgan Stanley; private dinners at home with the head of JPMorgan Chase.

Most importantly, Becker and Morgenson raise the question of why – with all that frequent contact – Geithner never sounded the alarm about these banks? Indeed, as I’ve pointed out before, Geithner took no steps to prevent $2 trillion in US Treasury bond trades go unsettled for 7 months – until it was over, when he called a meeting of the same bankers that caused the problem to have them do a study, take a survey, make some suggestions, etc. The one action that needed to be taken – to enforce finality of settlement – was never on the table.

When the banks behaved recklessly in lending, trading, issuing derivatives and generally fueling the Bonfire of their Vanities, according to Becker and Morgenson, Geithner’s idea was to have the federal government “guarantee all the debt in the banking system.” As Martin Weiss asks in his ads for Money and Markets, “Has U.S. Treasury Chief Geithner LOST HIS MIND?”

Since 1998, most major American metropolitan areas have seen a decline in employment located close to the city center as jobs have moved farther into the suburbs.

A recent report by the Brookings Institution determined that this “job sprawl” threatens to undermine the long-term regional and national prosperity.

The report analyzes the spatial distribution of jobs in large metropolitan regions and how these trends differ across major industries, in addition to ranking cities according to their amount of job sprawl.

The report found that only 21 percent of employees work within three miles of downtown. Using the period before the current recession, the report found that while the number of jobs has increased, 95 of 98 metro areas analyzed saw a shift of jobs away from the central core.

The Brookings Institute argues that “allowing jobs to shift away from city centers hurts economic productivity, creates unsustainable and energy inefficient development and limits access to underemployed workers.” Yet this may be more a matter of Brookings ideology than a likely far more complex reality.

Job sprawl is greatest both in areas that have clearly declined – such as Detroit – as well as growing regions like Dallas-Fort Worth. Nor does concentration guarantee success, as can be seen by the mediocore performance of the more concentrated New York region. Yet virtually everywhere jobs continue to sprawl, in many cases faster than even population. Maybe it’s time to learn how to adjust to the emerging future rather than yearn for a return to the economic and geographic structure of the last century.

The Illinois state budget is on life support, with a $4 billion shortfall projected for this year and even more in 2010. So what’s a state to do?

In a move that has some scratching their heads, Governor Pat Quinn has proposed an increase on the tax rate for both personal and corporate income tax.

For a state ranked 48th in overall economic performance and 44th in economic outlook, such a tax hike seems questionable. Corporate and personal income is lagging. According to a recent study, non-farm payroll employment has only risen 3.6 percent and the growth of per capita income ranks 39th in the nation.

The state’s private sector is largely responsible for fueling a well-funded public sector. Such a tax increase could further suffocate growth, which in turn will impact the public sector as well.

Along with its persistent corruption, Illinois’ poor economic showing may become yet another embarrassment to an administration whose top leadership comes from the increasingly bedraggled Land of Lincoln.

It also wasn’t that long ago that Congress held hearings on the bonuses paid to AIG employees after the bailout. Now, according to New York Times reporter Louise Story Wall Street compensation is rising back to where it was in 2007 – the last year that these firms made oodles of money with investment strategies that turned toxic the next year.

And, yeah, we get it – there is a theoretic connection between compensation and performance. But we also know that there’s a difference between theory and practice. Too many of the same employees who either perpetrated the events leading to the meltdown or stood idly by while it happened are still in place.

When AIG finally revealed what they did with the bailout money, we found out that a big chunk of it went overseas. Now, New York Post reporter John Aidan Byrne tells us that the bailout recipients are bailing out – on U.S. workers! Story found that Bank of New York Mellon, Bank of America and Citigroup, all recipients of billions of bailout dollars, are shifting more jobs overseas. The explanation, that nothing in TARP prohibits them from moving jobs out of the US, is so lame I’m surprised Story even bothered to mention it.

The initial indicators of the current financial meltdown were visible in mid-2007. The deeper, underlying causes were recognized, talked about in Washington and then ignored as far back as 2004. The collective memory is short. Nobody wants to hear the bad news, especially when it’s this bad and it goes on for this long. The morning you wake up and wish the financial meltdown would just go away is your most dangerous moment – wishing won’t make it so.

Of the three monitors established by the legislation that created the Troubled Asset Relief Program (TARP), only one has the authority to prosecute criminals. That is the Office of the Special Inspector General (SIGTARP) whose motto is “Advancing Economic Stability through Transparency, Coordinated Oversight and Robust Enforcement.” The Special Inspector General in charge, Neil Barofsky, told Congress before the recess that he was by-passing the Rogue Treasury to get answers directly from TARP recipients about what they are doing with the bailout money. Now, SIGTARP has set up a hotline (877-SIG2009) for citizens to report fraud or “evidence of violations of criminal and civil laws in connection with TARP.” To date, they have received 200 tips and launched 20 criminal investigations.

What started out as a bailout costing $750 billion quickly turned into $3 trillion – an amount about equal to the U.S. government’s 2008 budget. This week, SIGTARP released a 250-page report in an attempt to place “the scope and scale [of TARP] into proper context” and to make the program understandable to “the American people.” I can’t recommend that you read a report of that length, or even that you download it (more than 10 megabytes) unless you have broadband internet access. (In fact, I don’t understand what makes them think that the American people are going to understand anything that takes 250 pages to explain… Isn’t over-complicating one of the problems they want to solve?) You can get all the high points in Barofsky’s statement to the Joint Economic Committee, which is only 7 pages and a few hundred kilobytes. If you have more time than patience, you can watch the testimony on C-SPAN.

I applaud the hard work of the SIGTARP to provide oversight to Treasury even though they are “currently working out of the main Treasury compound.” Let’s hope they can break free of the hazards associated with the self-regulation that got us into this financial mess in the first place.

|